eCommerce Payment Gateway | Its Meaning, Types, and Features

What is a Payment Gateway?

Payment gateways work as a conduit between your eCommerce portal and the customers’ bank for processing the payment. Without a reliable gateway, you will not receive the money into your bank. In simple words, it bridges the gap between your and the customers’ bank account for the transfer of funds. However, designing an inhouse payment gateway which is highly secure and smooth is a costly affair. For the same reason, the majority of online store owners tie-up with third parties like Paypal, BlueSnap, Authorize.Net, and more to establish their payment gateway.

However, designing an inhouse payment gateway which is highly secure and smooth is a costly affair. For the same reason, the majority of online store owners tie-up with third parties like Paypal, BlueSnap, Authorize.Net, and more to establish their payment gateway.

How does a Payment Gateway operate?

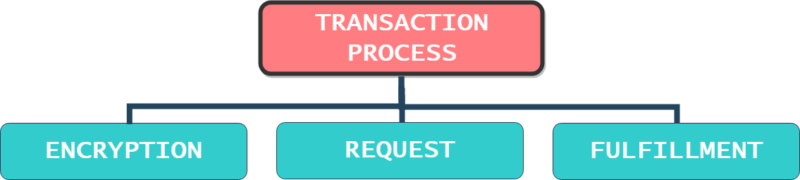

A payment gateway undergoes three processes for completing a transaction.Encryption: It means the process of converting customers’ financial information into codes for maintaining security. This encryption process is done by the payment gateway before sending a request to the bank.

Request: In this step, a request is raised by the payment gateway to the customers’ bank for authorizing the transaction.

Fulfillment: Once the payment gets the approval from the bank, the next set of steps related to product packaging and shipment are initiated.

Different Types of Payment Gateways

The online checkout process varies from one eCommerce website to another due to the type of payment gateway adopted. These are broadly categorized in parts which are discussed as follows: Hosted Payment Gateway: In the hosted payment gateway, customers are redirected to a gateway portal for completing the payment process. Once the customer clicks on the gateway link, he or she is redirected to the PSP (payment service provider) page. At PSP, the customer registers all payment-related information and gets redirected back to the eCommerce website page once the transaction is authorized. PayPal is a popular payment system that offers hosted payment gateway services. A hosted payment gateway is favored because of security and familiar user-interface. But a major drawback is that since users are directed to a third-party website, the owner cannot control a user’s checkout experience.

Self Hosted Payment Gateway: As the name goes, this payment gateway is hosted on the eCommerce website itself. All the financial information is collected at the online store, and this data is sent to the third party URL for processing the transaction.

It is favored because the buyers do not leave the merchant’s website, which enables the website owners to control and/ or customize the entire shopping experience. But a principal drawback is the need for setting up an in-house support team to solve technical glitches.

Connecting with the Bank: It means integrating an eCommerce website’s payment process with a bank’s portal instead of a third-party. As soon as customers initiate the checkout process, they are directed to the bank’s gateway. Once the payment is complete, the customers are redirected back to the eCommerce website.

An easy setup process makes local bank integration a great choice for small businesses. But it lacks advanced features like refund management, handling recurring payments offered by private payment gateway service provider.

A hosted payment gateway is favored because of security and familiar user-interface. But a major drawback is that since users are directed to a third-party website, the owner cannot control a user’s checkout experience.

Self Hosted Payment Gateway: As the name goes, this payment gateway is hosted on the eCommerce website itself. All the financial information is collected at the online store, and this data is sent to the third party URL for processing the transaction.

It is favored because the buyers do not leave the merchant’s website, which enables the website owners to control and/ or customize the entire shopping experience. But a principal drawback is the need for setting up an in-house support team to solve technical glitches.

Connecting with the Bank: It means integrating an eCommerce website’s payment process with a bank’s portal instead of a third-party. As soon as customers initiate the checkout process, they are directed to the bank’s gateway. Once the payment is complete, the customers are redirected back to the eCommerce website.

An easy setup process makes local bank integration a great choice for small businesses. But it lacks advanced features like refund management, handling recurring payments offered by private payment gateway service provider.

Features to Look Out for While Choosing a Payment Gateway

Finding the right payment gateway is essential for the successful functioning of an online store. An ideal payment gateway should be equipped with the following features. Multi-Payment Methods: It is not necessary for all the online buyers to use debit or credit cards as their preferred methods of payment. The population is divided into using different methods like cards, net banking, online wallets, and more. So the gateway should provide multiple payment options. Otherwise, it will lead to loss of precious revenue in the form of lost customers. Multi-Currency Processing: Capability to sell anywhere and anytime in the world, is the edge online stores have over traditional brick-and-mortar establishments. And this means having global customers who do not necessarily have your home currency to make payments. The solution is a payment gateway supporting multiple currency transactions, thereby enabling the people from any country to enjoy seamless shopping experience. Multi-Language Options: Payment gateways need to offer multiple language options if they provide multiple payment options. This will permit customers to perform transactions without any linguistic barriers. Responsive Mobile Interface: In 2018, almost 40% of the total eCommerce shopping sales were executed through smartphones. You wouldn’t want to miss an impressive amount of money by setting up a not-so mobile-friendly payment gateway. With so many people shifting to mobile shopping, it goes without saying that gateway should deliver the same experience seamlessly on any device.

Secure Payment Gateway: The reputation of SaaS eCommerce platforms is based on the steps taken to make the website secure like adhering to payment card industry guidelines, choosing trusted payment gateways, etc. The reason is that any leakage of customer’s financial related information will not only negatively impact a website’s credibility but will also make the business prone to lawsuits.

Responsive Mobile Interface: In 2018, almost 40% of the total eCommerce shopping sales were executed through smartphones. You wouldn’t want to miss an impressive amount of money by setting up a not-so mobile-friendly payment gateway. With so many people shifting to mobile shopping, it goes without saying that gateway should deliver the same experience seamlessly on any device.

Secure Payment Gateway: The reputation of SaaS eCommerce platforms is based on the steps taken to make the website secure like adhering to payment card industry guidelines, choosing trusted payment gateways, etc. The reason is that any leakage of customer’s financial related information will not only negatively impact a website’s credibility but will also make the business prone to lawsuits.

Built-In Analytics: Just like you use Google Analytics and other SEO related tools to monitor and create strategies for increasing the website’s traffic. The payment gateway should also have an in-built feature for generating sales-related analytic reports to help in devising plans for further revenue growth. It will help you gain insights on how to improve and expand the business.

Built-In Analytics: Just like you use Google Analytics and other SEO related tools to monitor and create strategies for increasing the website’s traffic. The payment gateway should also have an in-built feature for generating sales-related analytic reports to help in devising plans for further revenue growth. It will help you gain insights on how to improve and expand the business.

Conclusion: We hope the information shared above was able to resolve your queries related to the payment gateway for eCommerce websites. If you have any more details on this topic and want to share it with everyone, please write to us via the comment section given below.

Subscribe to our Blog

Read our newly created blogs delivered straight to your inbox.

WhatsApp Us

WhatsApp Us